Introduction

Economic historians have long emphasized the importance of financial institutions in industrialization. More recently, economists have begun more intensive investigation of the links between financial system structure and real economic outcomes. In theory, the organization of financial institutions partly determines the extent of competition among financial intermediaries, the quantity of financial capital drawn into the financial system, and the distribution of that capital to ultimate uses.1 The choice between universal and specialized banking may affect interest rates, underwriting costs, and the efficiency of secondary markets in securities. Furthermore, the presence or absence of formal bank relationships may affect the quality of investments undertaken, strategic decision-making, and even the competitiveness of industry.2 Not long ago, when one talked of India’s commercial banks, one almost always referred to the huge network of public sector banks in the country. Now the situation has somewhat changed; one conjures up the images of not only the public sector banks, but also those of the new generation and old generation private sector banks and foreign banks.3 In this context, a review of the various factors like universal banking, capital, products and the regulatory environment that have a bearing on the banking industry of the day is relevant.

Materials and Methods

Chinnappa T B and Karunakaran N (2021) studied the road ahead of Indian banking. Agrawal K.K. (2005), Anju Singla, Arora R S (2005) and Karunakaran N (2020) analyzed the financial performance of public sector banks. Singh, Ranbir (2003) examined the profitability management in Banks under deregulated environment. Soji M Sebastian and Karunakaran N (2020), Subramanya M., Sharma, P. and Amaraveni, (2005) studied the CRM in Banks. Chinnappa and Karunakaran N (2021) examined the consolidation in the Banking Industry, HR challenges, consequences and solutions. To understand the broad implications of various factors like universal banking, capital, products and the regulatory environment, important reports and articles were used for reference.

Analysis and Discussion

Universal banking: a perspective

In the Indian context, the phenomenon of universal banking “as different from narrow banking” is recently relevant. With the last Narasimham Committee and the Khan Committee reports recommending consolidation of the banking industry through mergers and integration of financial activities, the stage seems to be set for a debate on the entire issue.4 A universal bank is a “one-stop” supplier for all financial products and activities, like deposits, short-term and long-term loans, insurance, and investment banking, and so on. Global experience with universal banking has been varied. It is prevalent in different forms in many European countries, such as Germany, Switzerland France and Italy.

Research on the effects of universal banking has been inconclusive as there is no clear-cut evidence in favour of or against it anywhere. Some recent phenomenon, like the merger between Citicorp (banking group) and Travelers (insurance group) confirmed the fact that universal banking is to stay. The standard argument given everywhere also by the various Reserve Bank committees and reports in favor of universal banking is that it enables banks to exploit economies of scale and scope.5

By diversifying, the bank can use its existing expertise in one type of financial service in providing the other types. So, it entails less cost in performing all the functions by one entity instead of separate specialized bodies.6 A bank possesses information on the risk characteristics of its clients, which it can use to pursue other activities with the same clients. This again saves cost compared to the case of different entities catering to the different needs of the same clients. A bank has an existing network of branches, which can act as shops for selling products like insurance. This way a big bank can reach the remotest client without having to take recourse to an agent. Many financial services are inter-linked activities also. A bank can use its instruments in one activity to exploit the other. The overall performance of Indian banking structure and its core functions has been given in Figure 1.

Figure 1

Overall performance of the indian banking structure (Source:https://www.google.com/urlsa=i&url=https%3A%2F%2Frbi.org.in%2FScripts%2FPublicationReportDetails.)

In the benefits accruing to customers, the idea of “one-stop-shopping” saves a lot of transaction costs and increases the speed of economic activity. Another manifestation of universal banking is a bank holding stakes in a firm. A bank’s equity holding in a borrower firm acts as a signal for other investors on the health of the firm, since the lending bank is in a better position to monitor the firm’s activities. This is also useful from the investors’ point of view.7 of course, all these benefits have to be weighed out against the problems. The obvious drawback is that universal banking leads to a loss in economies of specialization. Then there is the problem of the bank indulging in too many risky activities. To account for this, appropriate regulation can be devised, which will ultimately benefit all the participants in the market, including the banks themselves.

In spite of the associated problems, there seems to be a lot of interest expressed by banks and financial institutions in universal banking. In India, too, a lot of opportunities are there to be exploited. Banks, especially the financial institutions, are aware of it. And most of the groups have plans to diversify in a big way even though there might not be profits forthcoming in the short run due to the switching costs incurred in moving to a new business.8, 9, 10, 11, 12

The long-run prospects, however, are very encouraging. At present, only the regulatory authority, i.e. the Insurance Regulatory and Development Authority (IRDA), has allowed an “arms-length” relationship between a bank and an insurance entity. This means that commercial banks can enter insurance business either by acting as agents or by setting up joint ventures with insurance companies.

Development financial institutions (DFIs) can turn themselves into banks, but have to adhere to the statutory liquidity ratio and cash reserve requirements meant for banks. Even then, some groups like the HDFC (commercial banking and insurance joint venture with Standard Assurance), ICICI (commercial banking), SBI (investment banking), etc., have already started diversifying from their traditional activities through setting up subsidiaries and joint ventures. In a recent move, the Life Insurance Corporation increased its stakes in Corporation Bank and is planning to sell insurance to the customers of the Bank. Corporation Bank itself has been planning to set up an insurance subsidiary since a long time. Even a specialized DFI, like IIBI, is now talking of turning into a universal bank. All these can be seen as steps towards an ultimate culmination of financial inter mediation in India into universal banking.

Augmentation of capital

Banks these days are running short of lendable funds since the rate of growth in deposits has not kept pace with the rate of growth in advances. Additionally, prudential norms warrant, inter alia, that banks in India adhere to a capital adequacy ratio. The resultant cash crunch has forced some of the banks to go in for ECB’s (External commercial borrowings) too although the wisdom behind such borrowings is questionable as the RBI has rightly insinuated recently.

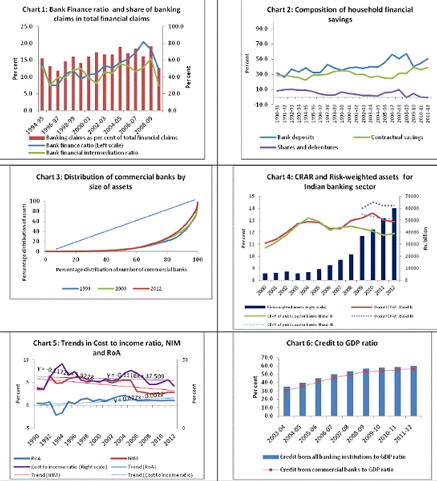

Product innovation

An avenue available for banks to stay afloat in the dog-eat-dog business of banking is to consider product innovation seriously. For too long, banks, in particular the public sector banks, have been dishing out run-of-the-mill financial products. But the new generation private sector banks and foreign banks have been introducing innovative products (Figure 2, Figure 3). This has begun to rub off public sector banks too.

Regulatory environment

More proactive measures are needed from the regulator in the light of the highly competitive environment the banking industry finds itself in today (Table 1).

Table 1

Environmental scanning by banks in India

Conclusion

Convergence of the services of more industries and organizations is emerging so as to provide holistic service offerings to the discerning customer, and banks would be the prime targets by customers if they have to provide service levels, which match their expectations. This would necessitate that banks operate in an environment, which will facilitate ease of inter-operability. Just as inter-operable IT systems and Straight Through processing (STP) will become the order of the day, inter-operable business domains will also prevail and banks have to overcome this challenge in their stride. This will also be observed in managing external functions such as Business Process Outsourcing, management of IT service providers and better vendor management — all of which are hitherto unknown domains for the banks’ personnel. The challenges staring at banking today need not result in a feeling of inadequacy. The I T framework in India is on strong ground and the industry has been showing significant growth rates in the previous years, with the financial sector having benefited immensely from the offerings of IT. Banks have commenced to grow laterally and at an exponential rate and have the best talent of personnel and the best institutes to develop more resources and the best brains to manage these changes.